2020 State of Transportation: Truck Driver Recruitment

The transportation industry is discovering how a massive change in consumer behavior due to the COVID-19 pandemic is affecting truck driver recruitment. At no other time in the industry’s history has one factor been so disruptive. How has COVID-19 influenced the recruitment process and truck driver employment decisions? Here is the 2020 State of Transportation Truck Driver Recruitment:

DMV Shut Down

For months, DVMs shut down, keeping 1,000s of new drivers from entering the market. Since March 2020, fleets hiring students have been struggling. Fleets hiring one year of experience will most likely feel the effects well into 2021. Many carriers are already feeling the pinch as competition for the existing and qualified drivers is intensely high.

FMCSA Drug Clearing House

In the first six months, the secure online database assisting employers with drug tests has led to over 21k failures and disqualifications.

2020 Cares Act

The CARES Act signed into law by President Trump on March 27, 2020, gives states the option of extending unemployment compensation to independent contractors and other workers who are ordinarily ineligible for unemployment benefits. To limit exposure to COVID-19, many truck drivers are opting to take unemployment benefits.

Escalating COVID-19 Exposure

Because the large population of truck drivers is over fifty (average age: 55, npr.com), the risk of complications after positive COVID-19 tests are higher. The increased risk is a factor in keeping many truck drivers from switching carriers or increase month trip counts.

Spike in Warehouse Jobs

Companies like Amazon and Walmart are creating warehouse jobs up to $25 per hour. Truck drivers are being drawn to many warehouse positions because it keeps the exposure to COVID-19 lower than when on the road full-time.

Freight Levels Increasing

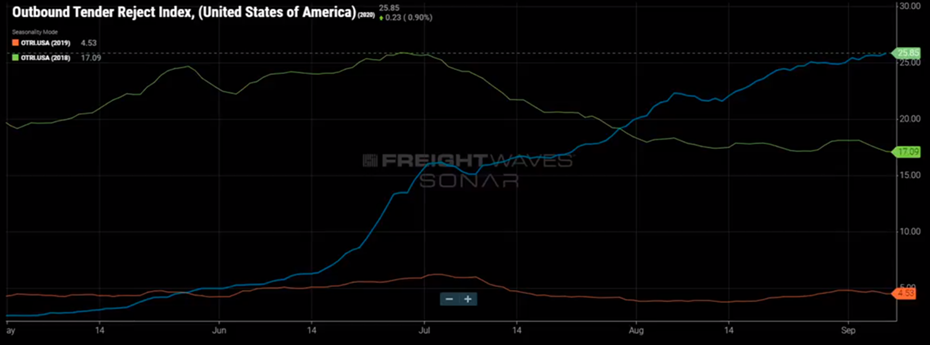

Freightwaves.com data shows the 2020 outbound tender volume index (measuring how much freight is moving through the domestic supply chain) is 56% higher than the 2019 Labor Day weekend and 59% higher than 2018 (the biggest year on record).

At the same time, tender rejections are above 25% (1 out of every 4 loads are being rejected) compared to 2019 Labor Day at 4.5%, and 2018 Labor Day weekend at 17%.

According to Truckstop.com, the Dry Van rate per mile according is $2.76 (68 cents higher than this time last year), $1.18 higher than May 3rd, 2020 (unprecedented rate increase in just 4 months). Even with these incredible rates, loads are being rejected 1 out of 4 due to significant freight increases and a noticeable driver shortage.

Demand Market Vs. Supply Market Shifts

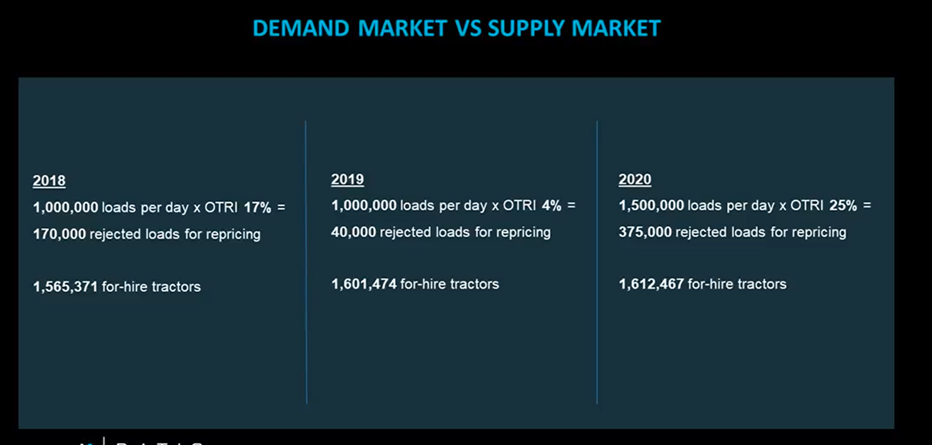

A 3-year chart by FreightWave.com reveals loads per day for Labor Day week 2020 are up 50% (1.5 million vs. 1 million in 2019), and load rejections are over 25% (1 out of 4). For hire, tractors have only increased 10,993 in 2020 (less than 1% increase) vs. 2019, while loads per day are up 50%.

Conclusion

Unfortunately, there are no quick fixes to the current squeeze on truck driver demand. Carries must be diligent with recruiting efforts. Many trucking companies have begun to increase sign-on bonuses and other truck driver perks. As the country rolls into the holiday season, the peak time for most fleets, drivers’ demand will continue to intensify.

For more information on the State of Transportation: Truck Driver Recruitment, contact Mike Fisk, Tri-State Motor Transport Marketing/Hiring/Development Director at 623.344.1206.

Interesting in driving for Tri-State Motor Transport? Apply Now.

You may also enjoy: The Highest Paying Truck Driving Jobs